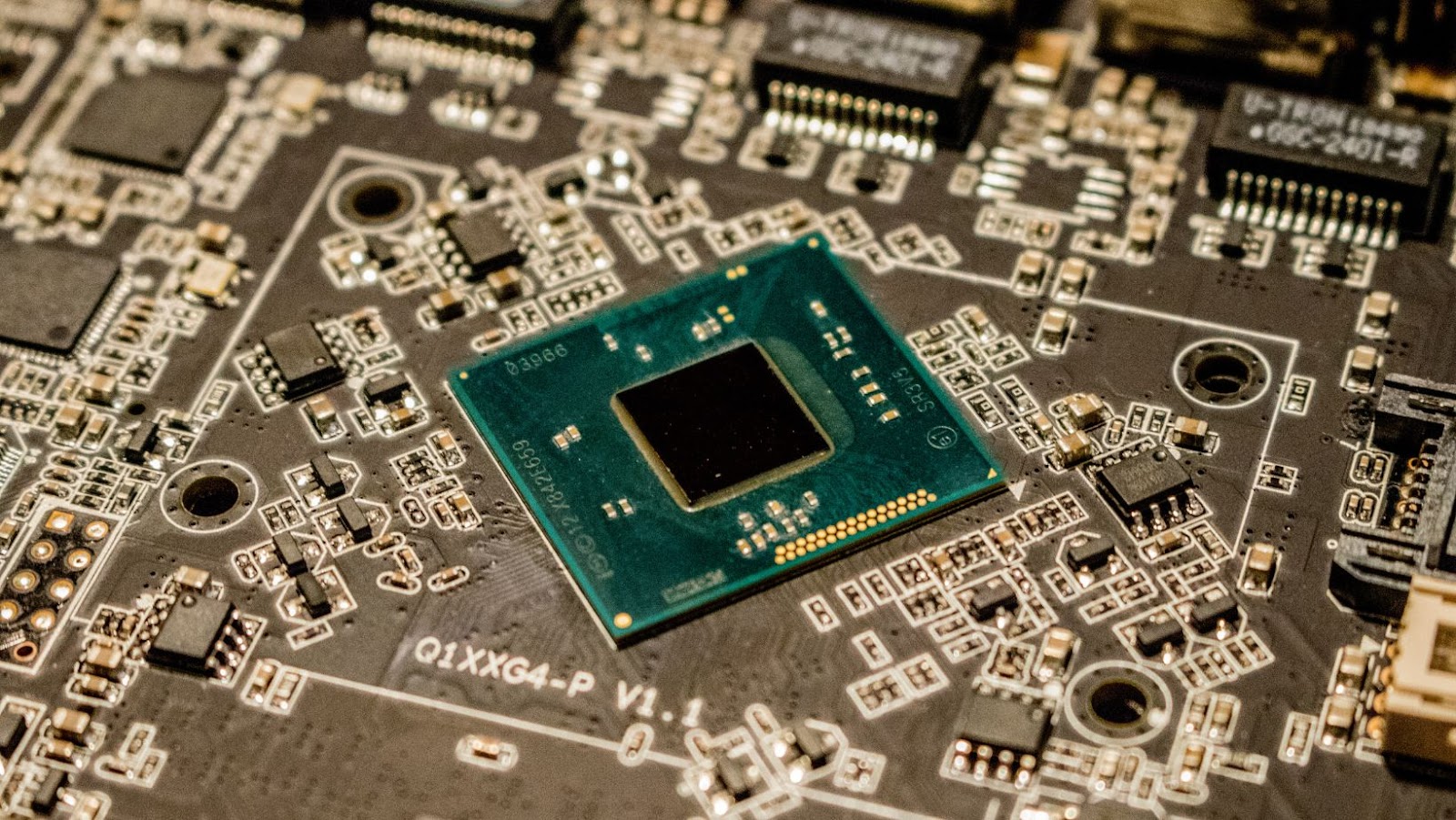

Intel has long been the preeminent chipmaker in the world, leading the semiconductor industry with its highly- advanced technology. But, in recent years, the company has been unable to stay competitive with smaller rivals as it struggled to keep up with trends that have shifted towards making more energy-efficient and low-power chips. It ultimately decided to outsource its production process to third-party foundries around the world, while also investing heavily into its own in-house capabilities.

Intel’s first major break into this sector came in 2019 when it began producing chips for some of its integrated platform partners, such as Microsoft and Apple. Despite initial success with these business partnerships, Intel failed to gain considerable market share due to its new facilities not being able to match those of rival foundries like Taiwan Semiconductor Manufacturing Company (TSMC). However, Intel’s fortunes changed dramatically with the announcement of a fabless agreement for Taiwan’s MediaTek earlier this year.

By partnering with MediaTek—one of Taiwan’s largest chipmakers—Intel is finally cracking the foundry business on a wider scale and opening itself up to vast markets outside the United States. Through this agreement MediaTek has chosen Intel as their manufacturing partner of choice and will source their entire 5G chip production at Intel’s flagship 2nm facility in Israel – bringing an unprecedented level of silicon innovation back home. This partnership is proof that Intel still maintains a strong grip on the semiconductor industry even amid competition from other firms such as TSMC or Samsung Foundry.

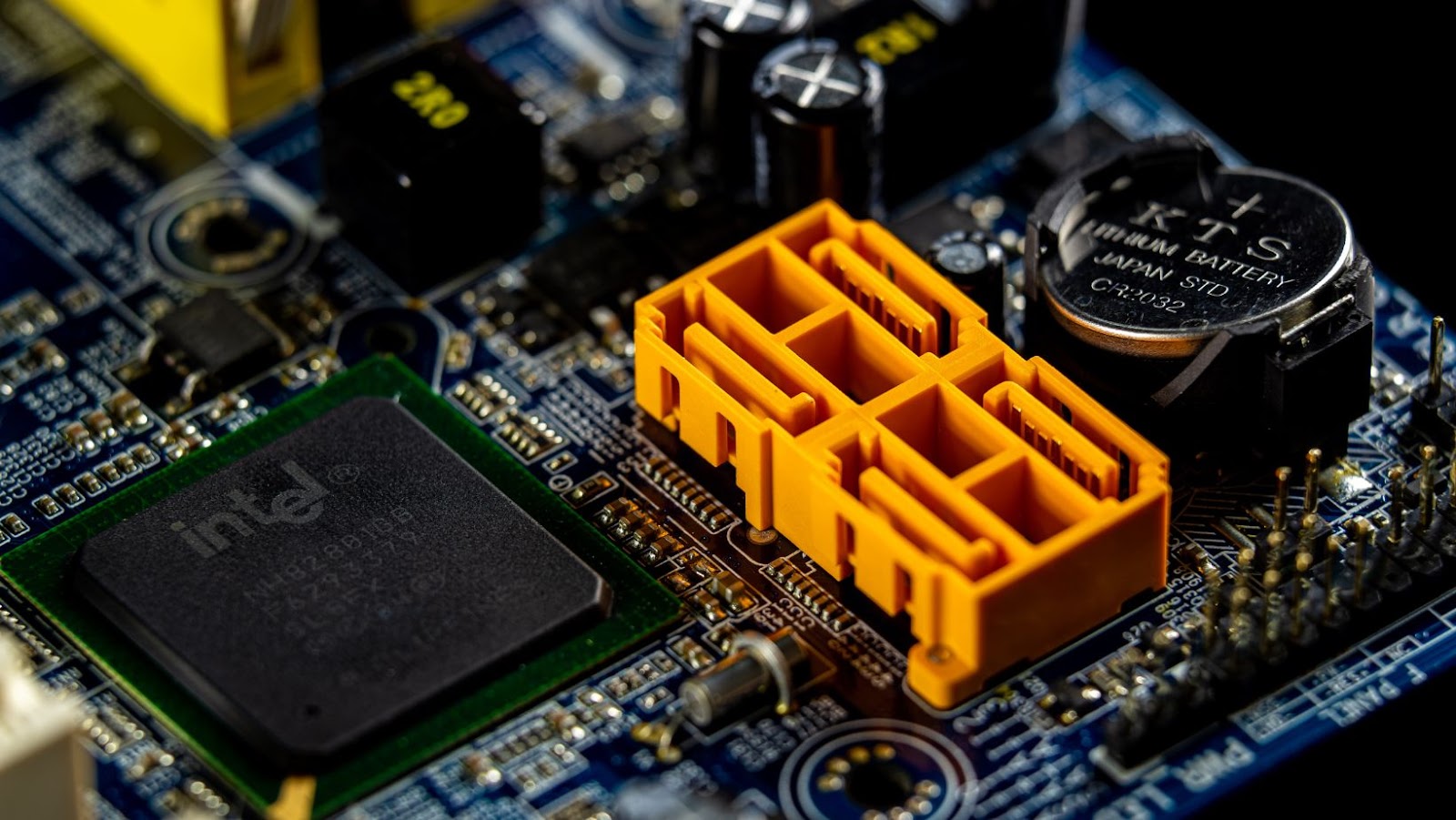

Intel’s Foundry Business

Intel’s foundry business has been rapidly growing in recent years. This has been most prominently demonstrated in its recently announced $600 million deal with Taiwan’s MediaTek. This deal is expected to provide Intel with a huge boost in its foundry business, as MediaTek is one of the largest fabless semiconductor companies in the world.

Intel’s foundry business is one of the main areas of focus for the company, so let’s take a closer look at what Intel stands to gain from this deal.

Intel’s Deal with MediaTek

Intel, the largest semiconductor company in the world, announced that it had signed a definitive agreement with Taiwanese semiconductor and telecommunications supplier MediaTek to serve as the sole manufacturer of MediaTek-designed chipsets and wi-fi modules. This marks Intel’s entry into the Foundry Business, a new revenue stream for them beyond their core chip manufacturing business.

As part of this deal, Intel has committed to investing billions of dollars in research and development into MediaTek’s chipsets and wi-fi modules over the next five years. Not only does this agreement allow Intel to expand its portfolio of clients to include MediaTek customers such as Lenovo, Huawei, BlackBerry and Nokia, but it also gives Intel access to advanced wafer fabrication processes that can enable higher levels of integration than what is currently achievable using other processes.

Intel plans to collaborate closely with MediaTek on developing process technologies that will enable customers to access products with better power efficiency and higher levels of performance across a variety of cutting-edge applications such as 5G communications infrastructures responsible for future Smart Cities initiatives. It should come as no surprise then that Intel is particularly looking forward to this deal as they are making some serious investments in order to secure top-notch results from their collaboration with MediaTek.

The joint venture between Intel and MediaTek shows just how successful Foundry business can be if two companies invest their resources strategically into creating strong partnerships that serve both parties equally well. Not only does this deepen their respective markets significantly but it also provides an additional incentive for customers who may have otherwise avoided investing in high-end technologies; all while giving them peace of mind knowing that their projects are being built by one of the most reputable names in technology: Intel!

Intel is finally cracking the foundry business in its deal with Taiwan’s MediaTek

Intel, the tech giant with a long and storied history in semiconductors, recently announced an agreement with Taiwan’s MediaTek to fabricate custom chips for the latter’s product portfolio. This agreement serves as a major milestone in Intel’s efforts to expand its foundry business which it began back in 2013.

In recent years, Intel has gradually been building out its foundry business, making agreements with major companies to handle orders for custom semiconductor components. This can have significant financial benefits for both sides of the equation — Intel gets much-needed revenue from those contracts and the customers receive the fantastic products they require at the right prices. It is no wonder then that this dynamic is currently gaining traction in various technology circles.

The key benefit of Intel’s approach lies in tapping into its already existing resources such as existing fabrication plants and years of R&D experience designing and engineering chipsets. This allows Intel to turn around orders remarkably quickly while producing fantastic quality components at relatively low costs. These essentials are precisely what customers are typically looking for when considering a long-term supplier partnership.

Another factor that drives customers towards Intel’s foundry offerings is their commitment to providing cutting edge technology and innovation in areas such as artificial intelligence (AI), automotive, 4G/5G networks, 5nm chip design node, and even augmented reality (AR) applications within the scope of their services. All these points come together to make Intel an ideal provider for companies requiring specific parts built according to their precise specifications.

With this recent news of collaboration between Intel and MediaTek furthering their partnership beyond simply fabricating parts from existing designs but also making headway into brand-new ones — all without depending on outside players — it looks as though Intel is finally cracking open the foundry business it so desperately seeks!

Benefits of Intel’s Foundry Business

Intel’s foundry business promises a slew of benefits as the company enters into a deal with Taiwan’s MediaTek. The foundry business, an aggressive move into the production of chips, is expected to bring a range of opportunities. From increased profits to new product lines, Intel has a lot to gain by cracking the foundry business.

Let’s explore the potential benefits of this new development.

Increase in Revenue

The Intel Foundry Business has proven to be instrumental in driving revenue gains for the company. Intel’s chip production operations became profitable in the fourth quarter of 2020, hitting a peak of $6.7 billion in revenue. This represented an improvement of 35% year-over-year. By comparison, Intel’s total fourth quarter 2020 revenues were $19.7 billion, up 5% year-over-year.

Intel’s ongoing commitment to its foundry business has allowed it to capitalize on industry transition and move technologies deeper into the data center and communication infrastructure markets, generating more revenue regardless of where its customers are located or what market segments they service. By expanding investments in technologies that leverage existing IP portfolios, foundry customers have access to cutting edge solutions that support systems like artificial intelligence (AI), 5G networks and even semiconductor postprocessing services such as dev kits and embedded software development solutions; all contributing to higher revenues for Intel’s foundry business.

The successful launch of Intel’s 10nm process technology has enabled it to better meet customer demand for higher performance chips with lower power consumption rates and wider range of supported designs than competing vendors offer—another growth area for the foundry business as companies transition from 14nm/16nm processes to 10nm manufacturing technology.

Increase in Market Share

Intel’s foundry business is expected to increase the company’s market share by leveraging Taiwan-based MediaTek’s expertise. MediaTek has been a leader in the mobile platform industry for many years and brings its well-established position to Intel’s table. Through this alliance, Intel is finally cracking the foundry business and is able to achieve expertise in design and produce both 5G modems and System-on-Chip(SoC).

Intel’s foundry business will give it the ability to cross into new industries such as Artificial Intelligence, Autonomous cars, drones etc. It will also be able to tap into larger markets such as India and China where it does not currently have a foothold. The capabilities of its custom designs will help bring higher performance at lower costs. Additionally, Intel’s high performance products maintain its lead over competitors with comparable offers at much lower prices.

In addition, this deal with MediaTek provides Intel access to a technology that includes 4G LTE radio capable of connecting up to 1Gbps speeds on smartphones through Unlicensed/ Licensed carriers (NR/LTE). This technology helps connect millions of people across various continents with internet access which further broadens Intel’s local presence outside of North America and Europe.

Finally, customers can benefit from faster development cycles associated with chip manufacturing when using Intel’s FPGA technology which allows for more rapid prototyping than traditional methods would provide.

Challenges for Intel’s Foundry Business

Intel’s recent deal with Taiwan’s MediaTek to manufacture chips has placed it in a good position to eventually break into the global chip foundry business. However, Intel is still facing numerous challenges in this endeavor.

This section will discuss some of these challenges and how Intel can tackle them.

Competition from Other Foundries

The foundry space has become increasingly competitive in recent years as companies such as Samsung, TSMC and GlobalFoundries become more aggressive in their efforts to gain market share. Intel is facing major challengers even as it attempts to break into the foundry space with its partnership with MediaTek. Many of these rivals have established networks of customers and decades of experience in the business, making it difficult for Intel to find a way to compete on an even footing.

Intel has always maintained a competitive advantage when it comes to technological innovation, but other foundries are also innovating with respect to pricing and production capabilities. Additionally, most of Intel’s major rivals have scaled up their manufacturing capacities significantly over the past two years and are now offering more advanced nodes than many of Intel’s longer-term offering. This raises questions about whether Intel’s most advanced offerings will be able to remain competitive or whether they will simply become outdated within a few years.

At the same time, established foundries have been able to transition quickly from one process node to another due to their immense resources and deep fabrication experience, meaning that they can often easily adjust or pivot when faced with new conditions in the market. In contrast, though Intel does possess some unique capabilities in terms of both process technology and facilities management, these are not yet deployed on a mass scale and therefore may not be sufficient for them to keep up with rival competitors as demand ramps up over time.

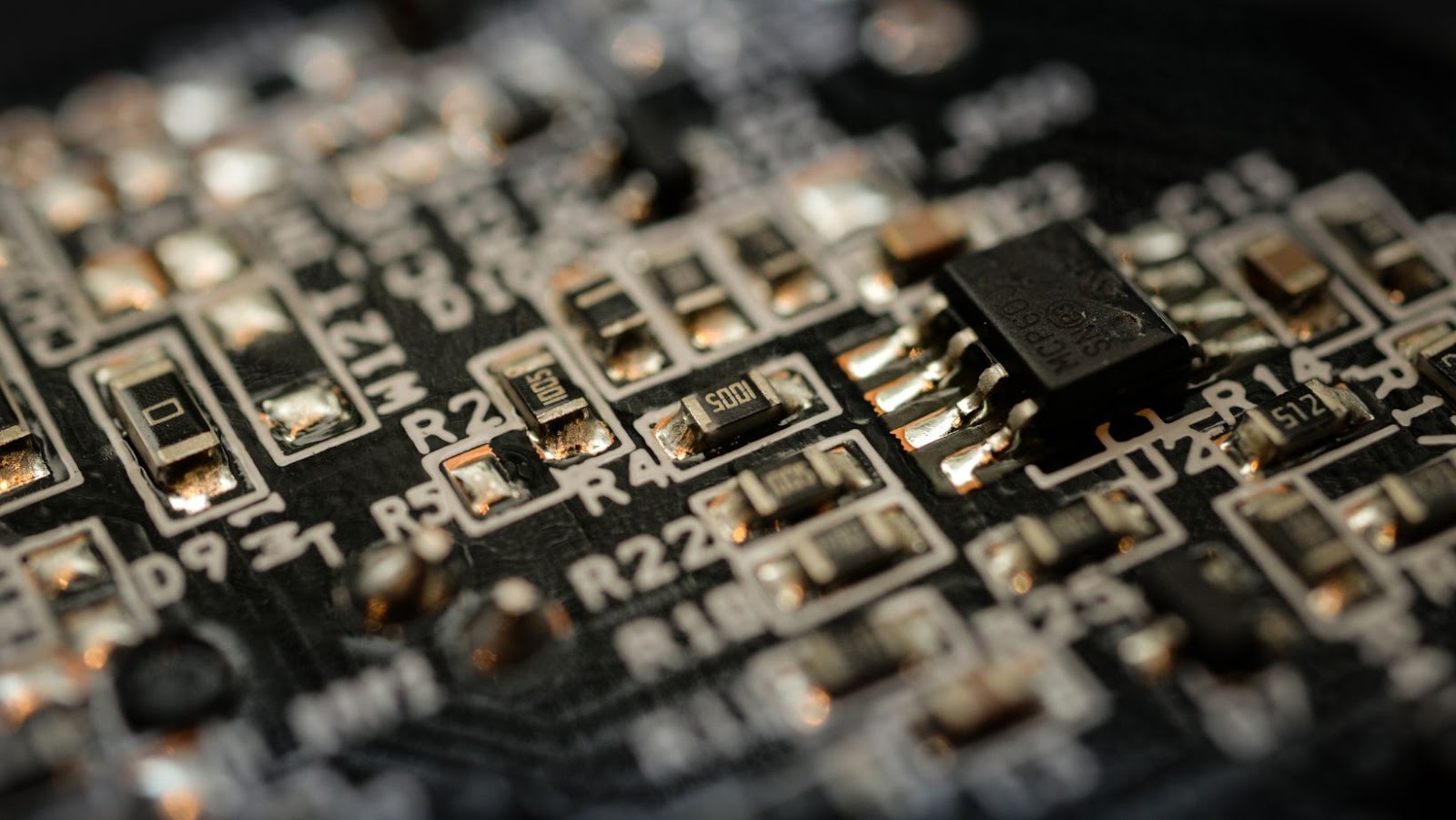

Limited Access to Advanced Technologies

Although Intel has a long history of manufacturing semiconductors and processors, the company is facing several challenges in its foundry business. Intel has traditionally focused on developing and producing cutting-edge technologies, while the foundry business usually revolves around more mass-produced products like smartphones and consumer electronics. As such, Intel may not have access to all the advanced technologies required for producing at the highest level of quality.

Another challenge Intel’s foundry business faces is competition from existing industry players. Other large companies like Taiwan Semiconductor Manufacturing Company (TSMC) have been providing contract chip manufacturing services for multiple companies for years, giving them a considerable advantage over new players to the market such as Intel. TSMC is also ahead of the game when it comes to adopting modern processes such as 5nm technology, while Intel will still need some time to catch up.

Lastly, although Intel may have superior products due to their commitment to development and innovation, small customers with large orders often do not take advantage of this due to size limitations or budget constraints. This can present a problem for Intel’s foundry business since they are accustomed to large orders with high margins due to their high-end technology. To overcome this challenge, Intel needs to attract more customers outside their traditional market by offering competitive pricing and creating innovative products tailored towards small orders.